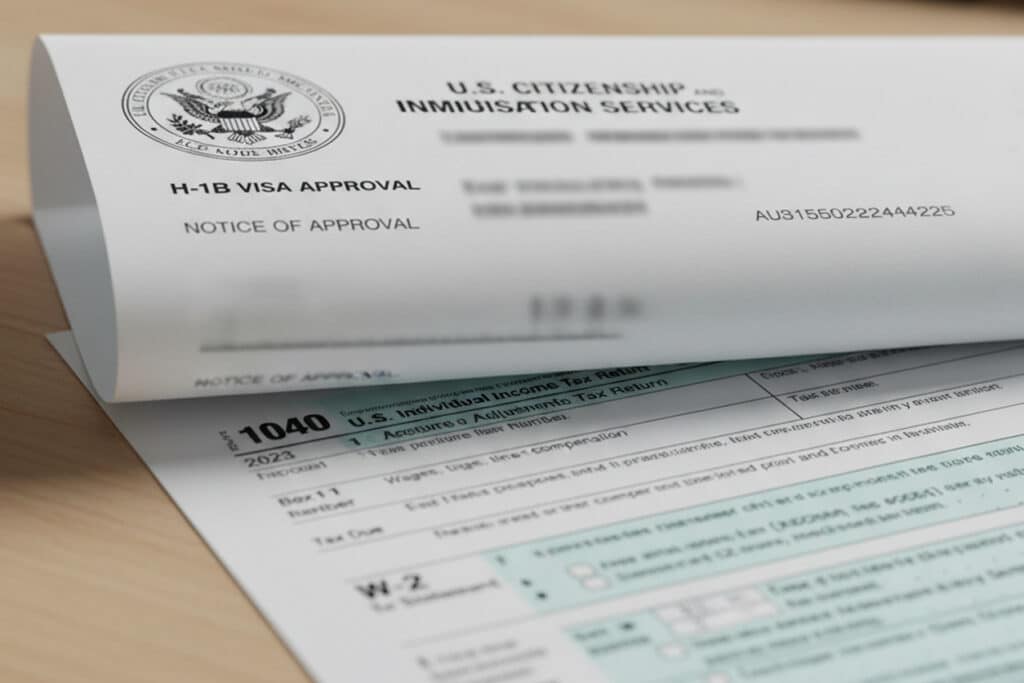

H-1B Taxes Explained: Filing Returns, Worldwide Income, and Immigration Compliance

Why H-1B Taxes Matter More Than Ever

If you’re in the U.S. on an H-1B visa, filing taxes isn’t just a financial task — it can directly affect your immigration journey. USCIS often reviews tax returns during visa renewals and green card applications, and mistakes can slow or even derail your case.

Recent policy shifts, including a $100,000 H-1B petition fee and a proposed “Golden Visa” program, have put even more focus on compliance. While employers shoulder most of these new costs, workers need to be aware that their own tax records are now part of the spotlight.

Do H-1B Holders Pay Taxes in the U.S.?

Yes. From the day you begin working in the U.S., your U.S. income is taxable. How much else you must report depends on whether you’re classified as a nonresident or resident alien for tax purposes.

- Nonresident aliens are taxed only on U.S. income.

- Resident aliens must report worldwide income.

For a detailed explanation of how residency is determined, read our H-1B Residency for Taxes guide.

If you’re on H-1B status and also have income or bank accounts abroad, you’ll need to report them once you’re considered a U.S. tax resident. Greenback specializes in helping international taxpayers navigate FBAR and FATCA. Learn more about our expat tax services.

H-1B Tax Filing Basics

Once you know your residency status, here’s how filing works:

- Nonresidents usually file Form 1040-NR (U.S. income only).

- Residents file the standard Form 1040 (worldwide income).

- Dual-status taxpayers may need both, if they switch during the year.

Related Article: Are You a Dual-Status Alien for US Tax Purposes?

In all cases, H-1B holders pay:

- Federal income tax

- State income tax (in most states)

- Social Security and Medicare (FICA) taxes

- Unlike F-1 students, H-1B visa holders are subject to payroll taxes.

Worldwide Income and Foreign Assets

Once you become a resident alien after passing the substantial presence test, the IRS requires you to report all global income, not just U.S. wages. That includes rental income, dividends, and business profits abroad.

To avoid double taxation, you may qualify for:

But reporting obligations go further. You may also need to file:

- FBAR (FinCEN Form 114): For foreign accounts totaling $10,000+ at any time.

- FATCA (Form 8938): For foreign assets over certain thresholds.

Missing these forms can trigger penalties of $10,000+ per account per year, even if no extra tax is owed.

H-1B Policy Shifts and Why Your Tax Record Matters

While the new $100,000 H-1B fee is aimed at employers, it’s expected to reduce job offers and increase scrutiny. USCIS and the Department of Labor are already stepping up enforcement on wages and compliance.

For H-1B workers, that means your clean, accurate tax record can serve as proof that your employment and immigration story checks out.

Key Deadlines to Remember

- April 15: The standard deadline to file your U.S. tax return.

- October 15: Final deadline if you requested an extension.

Why deadlines matter for immigration:

- USCIS often requires the last three years of tax returns. Missing a filing creates a visible gap.

- Filing dual-status years correctly helps avoid complications later in green card or citizenship cases.

- State deadlines (often the same as federal) can also affect your overall record if missed.

Dual-status years can be some of the trickiest to file correctly. Greenback has dedicated CPAs who focus exclusively on expat and dual-status tax returns. Get started today to ensure you’re set up for success.

Immigration and Taxes: One Connected Story

For H-1B holders, taxes and immigration are inseparable:

- Your immigration status determines your tax obligations.

- Nonresidents pay taxes on their U.S. income; residents must report their worldwide income.

- Foreign taxes help, but don’t replace U.S. filing.

- Credits and exclusions prevent double taxation, but you still must disclose.

- Your tax history is part of your immigration file.

- USCIS may request transcripts during renewals or when adjusting your status.

- Filing on time is a safeguard.

- It avoids IRS penalties and builds the compliance record immigration officers expect to see.

The takeaway: Your H-1B tax return isn’t just about money. It’s a critical part of your immigration record and one of the few factors you can fully control as policies shift.

If you’re unsure how your immigration status affects your U.S. taxes, Greenback’s accountants are here to guide you. From H-1B visa holders to green card applicants to full expats abroad, we can help keep your tax record clean and immigration-ready. Get started today.