Schedule K-1 for American Expats: What You Need to Know for 2025 Filing

- What Is a Schedule K-1 and Why Did I Receive One?

- How Does a K-1 Affect My Expat Tax Situation?

- What Are Schedule K-1 Instructions for Expats?

- Who Typically Receives Schedule K-1s as an Expat?

- Common Expat K-1 Scenarios and Solutions

- What If I'm Behind on K-1 Reporting?

- Working with K-1s: When Professional Help Makes Sense

Most expats who receive Schedule K-1 forms discover they owe little to no additional US taxes when their returns are prepared correctly. According to IRS data on international tax filings, the majority of Americans abroad who properly apply expat tax protections end up with minimal or zero additional tax liability on pass-through entity income.

Schedule K-1 is a tax form that reports your share of income, deductions, and credits from pass-through entities like partnerships, S corporations, or trusts. For expats, K-1s often come from foreign business partnerships, investment funds, or trust distributions. The relief comes from your expat tax protections: the Foreign Tax Credit and Foreign Earned Income Exclusion typically shield most K-1 income from additional US taxation.

Here’s what matters most: receiving a K-1 doesn’t automatically create a large tax bill. It means you need to report your share of entity income on your US return, where your expat tax benefits usually provide significant protection.

What Is a Schedule K-1 and Why Did I Receive One?

Schedule K-1 serves one specific purpose: it allocates your proportional share of a pass-through entity’s tax items. Unlike corporations that pay their own taxes, partnerships, S corporations, and certain trusts “pass through” their tax obligations to individual owners.

As an American expat, you might receive a K-1 from:

- Foreign Business Partnerships: If you’re a partner in an overseas business structured as a partnership for US tax purposes

- Investment Partnerships: Many international investment funds, hedge funds, or private equity investments issue K-1s to American investors

- Trust Distributions: Beneficiaries of US trusts living abroad receive K-1s showing their share of trust income

- S Corporation Stock: If you own shares in an S corporation while living overseas

The entity sends you the K-1 instead of paying taxes on your behalf. Your job is to report these amounts on your personal US tax return, where your expat tax protections typically provide significant relief.

How Does a K-1 Affect My Expat Tax Situation?

Here’s where being an American expat works in your favor. K-1 income flows through to your Form 1040, but it’s subject to the same expat tax protections shielding your other foreign income.

- Foreign Tax Credit Protection: If the entity paid foreign taxes on your behalf, you can often claim dollar-for-dollar credits against your US tax liability through the Foreign Tax Credit. Many expats find that their Foreign Tax Credits completely eliminate any US taxes on K-1 income.

- Example: Sarah, an expat in Germany, receives a K-1 showing $15,000 in partnership income. The German partnership paid $4,500 in local taxes on her behalf. She reports the $15,000 income on her US return but claims a $4,500 Foreign Tax Credit, often reducing her US tax to zero on this income.

- Business Income Exclusion: If your K-1 shows foreign earned income from active business participation, portions may qualify for the Foreign Earned Income Exclusion, allowing you to exclude up to $130,000 for 2025.

- Passive Income Considerations: Investment-related K-1 income typically doesn’t qualify for the FEIE but often benefits from Foreign Tax Credits paid by the investment entity.

Stop guessing. Download the expert guide now.

"*" indicates required fields

What Are Schedule K-1 Instructions for Expats?

Schedule K-1 instructions for expats involve more than just copying numbers to your tax return. You need to know how each K-1 item interacts with your expat tax situation.

Step 1: Identify Your K-1 Type

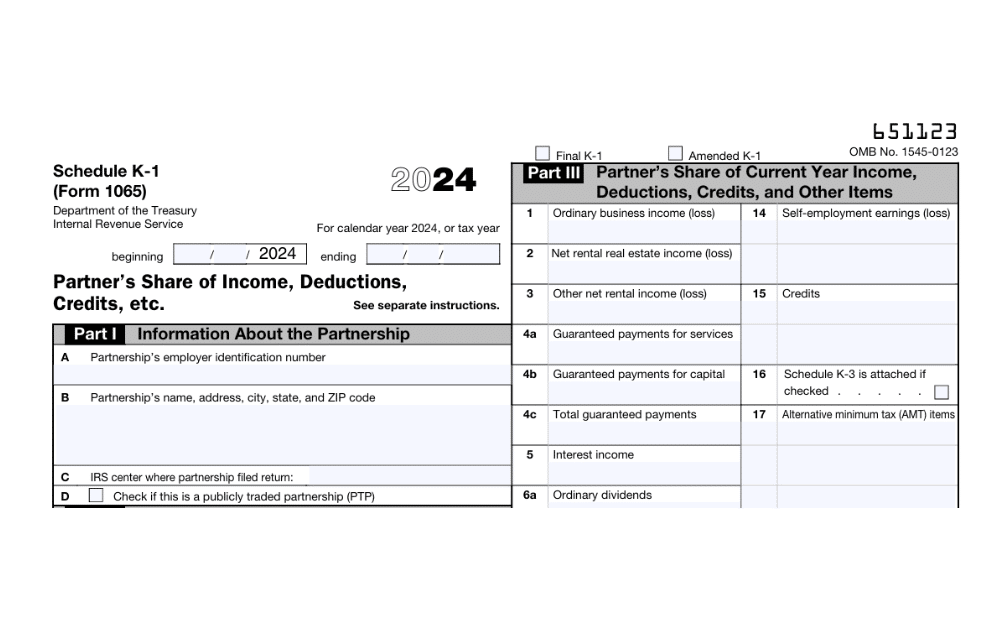

- Form 1065 K-1: From partnerships (most common for expat business ventures)

- Form 1120S K-1: From S corporations

- Form 1041 K-1: From trusts and estates

Step 2: Locate Foreign Tax Information

Look for Box 16 (Form 1065) or similar sections showing foreign taxes paid on your behalf. These amounts become Foreign Tax Credits on your return.

Step 3: Determine Income Classification

- Business income may qualify for FEIE if you materially participate

- Investment income typically uses Foreign Tax Credits for protection

- Passive income follows different rules from active business income

Step 4: Apply Expat Protections

To minimize US taxes, your CPA will integrate K-1 amounts with your Foreign Tax Credit calculations and FEIE elections.

Don’t submit the actual K-1 document with your tax return filing. Retain it in your personal tax records and transfer the relevant amounts to the corresponding schedules on your Form 1040.

Who Typically Receives Schedule K-1s as an Expat?

- Entrepreneur Expats frequently receive K-1s from foreign business partnerships. If you’ve started a business abroad with other partners, your entity likely issues K-1s to report each partner’s share of income and expenses.

- Corporate Expats with investment portfolios sometimes receive K-1s from international investment partnerships or funds that include American investors.

- Expat Retirees may receive K-1s from trust distributions, especially if they’re beneficiaries of family trusts while living abroad.

- Location-independent professionals who invest in US-based partnerships or S corporations continue receiving K-1s regardless of where they live.

The common thread? K-1 recipients have ownership interests in pass-through entities, meaning the entity’s profits and losses flow through to their personal tax returns.

Common Expat K-1 Scenarios and Solutions

- High-Tax Country Advantage: Expats in countries like Germany, France, or Australia often find their local taxes exceed any US tax liability on K-1 income. Foreign Tax Credits typically eliminate US taxes entirely.

- Low-Tax Country Strategy: Expats in countries like Singapore or the UAE may face some US taxes on K-1 income, but Foreign Tax Credits from other sources or partial FEIE benefits often provide relief.

- Multi-Country Complications: If your K-1 entity operates across multiple countries, different foreign taxes may apply to different income types. Professional guidance becomes essential for optimizing your tax position.

- Late K-1 Arrival: K-1s often arrive after other tax documents, sometimes forcing expats to file extensions. The automatic June 15 extension for expats provides extra time, but late K-1s can still complicate timing.

What If I’m Behind on K-1 Reporting?

Many expats discover they should have been reporting K-1 income in previous years. The good news? The Streamlined Filing Procedures offer penalty relief for catching up on unfiled returns.

Streamlined Procedures Benefits:

- No penalties for most expats who qualify

- Can amend three years of returns plus six years of FBARs

- Often results in refunds when expat protections are properly applied

Don’t panic if you’ve missed reporting K-1 income. Most expats who catch up through Streamlined Procedures find they owe little or no additional taxes once Foreign Tax Credits and FEIE are properly calculated.

Working with K-1s: When Professional Help Makes Sense

K-1 reporting for expats involves complex interactions between US tax rules, foreign tax systems, and expat-specific protections. Small mistakes in classification or credit calculations can cost you significant money or create compliance issues.

Consider professional help when:

- Your K-1 shows income from multiple countries

- You’re unsure whether income qualifies for FEIE treatment

- Foreign Tax Credit calculations seem complicated

- You’re behind on previous years’ K-1 reporting

- The entity’s tax structure is complex or unfamiliar

At Greenback, our expat-focused CPAs and Enrolled Agents handle K-1 reporting daily. We know how to maximize your Foreign Tax Credits, properly classify K-1 income types, and ensure compliance while minimizing your US tax liability. With a 4.9-star average across 1,200+ TrustPilot reviews, we’ve built our reputation on getting expat taxes right.

Next Steps for Your K-1 Situation

- If you’re current on filing: Review your K-1 carefully and gather any foreign tax documentation. Consider whether Foreign Tax Credits or FEIE provide better protection for your specific situation.

- If you’re behind on filing: Don’t wait. The Streamlined Procedures offer excellent penalty relief, and many expats discover they’re entitled to refunds once proper credits are applied.

- If you’re overwhelmed: You’re not alone. K-1 reporting combines some of the most complex areas of expat taxation. Professional guidance ensures you’re not leaving money on the table or creating compliance risks.

Contact us, and one of our customer champions will gladly help. If you need specific advice on your tax situation, click below to get a consultation with one of our expat tax experts.

The information provided here is for educational purposes only and should not be considered personalized tax advice. Tax situations vary greatly; you should consult a qualified tax professional regarding your specific circumstances.