Form 8812 for American Expats: How to Claim the Child Tax Credit for 2024 & 2025

- What Is Form 8812 and Why Do American Expats Need It?

- Does My Child Qualify for Form 8812 Credits?

- Which Tax Strategy Should I Choose: FEIE or Foreign Tax Credit?

- How Do I Complete Form 8812?

- What Income Limits Apply for 2025?

- What Documents Do I Need for Schedule 8812?

- What Mistakes Should I Avoid?

- When Will I Receive My Refund?

- Can I Claim Missed Credits from Previous Years?

- What's My Next Step?

Form 8812 (Schedule 8812) is the form you include with your U.S. tax return to claim the Child Tax Credit (CTC), the Additional Child Tax Credit (ACTC) if you qualify for a refund, and the Credit for Other Dependents. For American expats, it’s a key step to unlocking thousands of dollars in potential credits — even if you owe no U.S. tax.

Because of recent updates under the One Big Beautiful Bill, the amounts and eligibility rules for these credits depend on which tax year you’re filing for. Here’s a quick breakdown:

For the 2024 tax year (filed in 2025):

- Child Tax Credit (CTC): Up to $2,000 per child

- Additional Child Tax Credit (ACTC): Up to $1,700 per child

- Minimum earned income for refund eligibility: $2,500

For the 2025 tax year (filed in 2026):

- CTC: Increased to $2,200 per child

- ACTC: Still up to $1,700, with annual inflation adjustments beginning in 2026

- Minimum earned income for refund eligibility: Increased to $3,000

What Is Form 8812 and Why Do American Expats Need It?

Form 8812 (Schedule 8812) is used to calculate and claim three types of family-based tax credits:

- Child Tax Credit (CTC):

- 2024 return: Up to $2,000 per qualifying child

- 2025 return: Up to $2,200 per qualifying child

- Additional Child Tax Credit (ACTC):

- Up to $1,700 per qualifying child for both 2024 and 2025 returns (indexed for inflation starting in 2026)

- Credit for Other Dependents: Up to $500 per qualifying dependent (unchanged)

These credits are especially valuable for expats who often pay little or no U.S. tax due to the Foreign Earned Income Exclusion or Foreign Tax Credit.

Does My Child Qualify for Form 8812 Credits?

To claim the Child Tax Credit, your child must:

- Relationship Test: Your child, stepchild, adopted child, foster child, sibling, or descendant of any of these

- Age Test: Under age 17 at the end of the tax year

- Residency Test: Lived with you for more than half the tax year (temporary absences for school, medical care, or your military service don’t count)

- Support Test: Child didn’t provide more than half their own financial support

- Citizenship Test: Must be a U.S. citizen, national, or resident alien with a valid Social Security Number (SSN) issued before the tax filing deadline

New for 2025 filings (2025 return filed in 2026): At least one parent or spouse (if married filing jointly) must also have a valid SSN to qualify for the credit.

Which Tax Strategy Should I Choose: FEIE or Foreign Tax Credit?

This decision determines whether you can claim the Child Tax Credit refundable portion, potentially worth thousands.

If You Use the Foreign Earned Income Exclusion (FEIE):

Filing Form 2555 allows you to exclude:

- 2024 tax year: Up to $126,500 of foreign earned income

- 2025 tax year: Up to $130,000 of foreign earned income

The trade-off: You can still claim the non-refundable Child Tax Credit (up to $2,000 per child) to reduce taxes owed, but you lose access to the Additional Child Tax Credit (up to $1,700 refundable per child).

If You Use the Foreign Tax Credit Instead:

Filing Form 1116 lets you report your full foreign income on your U.S. return, then claim a dollar-for-dollar credit for foreign taxes paid. This often results in $0 U.S. taxes owed while maintaining eligibility for the refundable Additional Child Tax Credit.

How Much Could This Decision Cost Me?

Sarah’s Situation: American expat in the UK with two qualifying children, earning $80,000 annually, paying $18,000 in UK taxes.

With FEIE Strategy:

- U.S. taxable income: $0 (income excluded)

- Total Child Tax Credit benefit: $0 (no taxes to reduce)

With Foreign Tax Credit Strategy:

- U.S. taxable income: $80,000

- U.S. taxes before credits: $12,000

- Foreign Tax Credit: $12,000 (eliminates U.S. taxes)

- Additional Child Tax Credit: $3,400 (refundable)

- Total benefit: $3,400 refund

The Foreign Tax Credit strategy delivers a $3,400 advantage in this case.

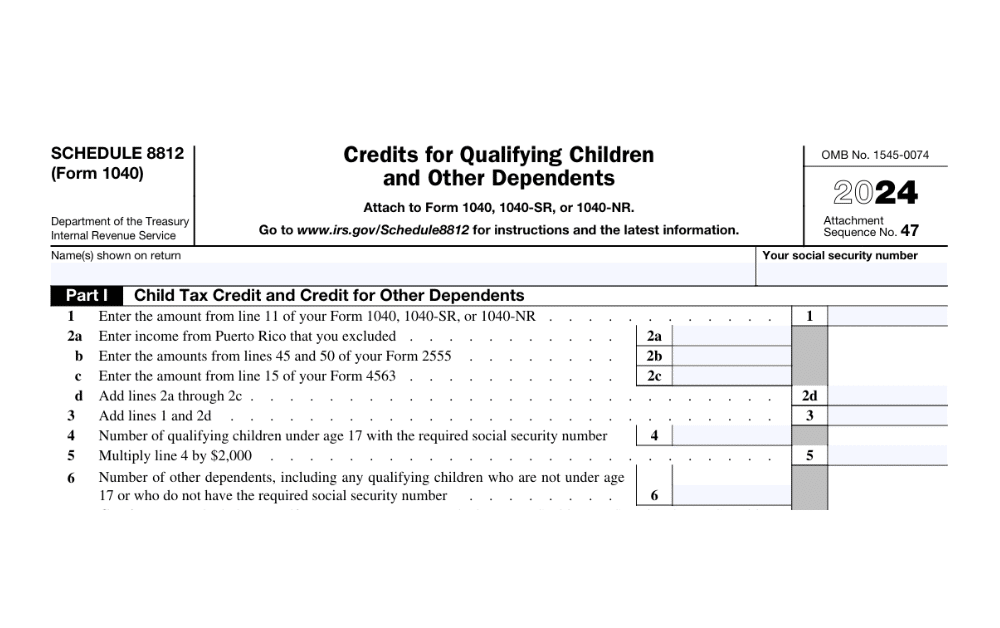

How Do I Complete Form 8812?

- Step 1: Complete your Form 1040 through line 15 first.

- Step 2: Fill out Part I of Schedule 8812 to calculate your Child Tax Credit and Credit for Other Dependents based on your modified adjusted gross income and number of qualifying children.

- Step 3: Complete Credit Limit Worksheet A (found in the Schedule 8812 instructions) to ensure you don’t claim more credit than taxes owed.

- Step 4:

- For 2024 tax returns: You must have at least $2,500 in earned income to qualify for the refundable portion (ACTC).

- For 2025 tax returns: The threshold increases to $3,000 in earned income.

- Step 5: Attach Schedule 8812 to your Form 1040 when filing.

What Income Limits Apply for 2025?

The Child Tax Credit phases out when your modified adjusted gross income exceeds:

- Married filing jointly: $400,000

- All other filing statuses: $200,000

The credit reduces by $50 for every $1,000 above these thresholds. These income limits apply to both 2024 and 2025 tax years.

What Documents Do I Need for Schedule 8812?

- Form 1040 (completed through line 15)

- Social Security Numbers for all qualifying children

- Form 2555 (if claiming FEIE) or Form 1116 (if claiming Foreign Tax Credit)

- Records of foreign taxes paid

- Documentation of the child’s U.S. citizenship or residency

What Mistakes Should I Avoid?

1. Filing Form 2555 Without Considering the Trade-off

Many expats use FEIE without realizing they’re giving up thousands in refundable credits.

2. Not Filing a Return Because They Owe No Taxes

You must file your tax return to claim refundable credits.

3. Using ITINs Instead of SSNs

Only Social Security Numbers qualify for the Child Tax Credit.

4. Missing the Three-Year Window

You can claim missed Child Tax Credits by filing amended returns up to three years after the original due date.

When Will I Receive My Refund?

The IRS can’t issue refunds for returns that correctly claim ACTC before mid-February. This applies to your entire refund, not just the credit portion.

Expect your refund within 21 days after filing if you file electronically, choose direct deposit, and have no errors.

Can I Claim Missed Credits from Previous Years?

Yes! You can file amended returns using Form 1040-X for up to three years after the original due date. At Greenback, we’ve helped expats recover thousands of dollars this way by switching from FEIE to Foreign Tax Credit strategies for prior years.

What’s My Next Step?

Your choice between FEIE and Foreign Tax Credit affects multiple aspects of your return, from retirement contributions to refundable credits. The Child Tax Credit for expats can transform tax season from a burden into a meaningful benefit for your family.

If you’re unsure which strategy works best for your situation, or if you’ve been missing out on the Additional Child Tax Credit in prior years, professional guidance can help you optimize your approach.

Have questions about the process or next steps? Contact us, and one of our Customer Champions will happily address all your concerns.

Whether you’re years behind or just unsure about the thresholds, our team is ready to help.

This article is for informational purposes only and does not constitute personalized tax advice. Tax laws can change, and individual situations vary. Please consult with a qualified tax professional for advice specific to your circumstances.