Form 8993: How American Expats Can Reduce US Taxes on Foreign Business Income

- What Is Form 8993 and Who Must File It?

- How Can Form 8993 Reduce Your US Tax Bill?

- Do You Need to File Form 8993?

- What Are the Key Deadlines for Form 8993?

- How Do You Calculate Your Section 250 Deduction?

- What Are Common Expat Business Scenarios?

- What Are Common Form 8993 Mistakes to Avoid?

- What If You're Behind on Filing?

- How Does Form 8993 Coordinate with Other Expat Tax Benefits?

- Should You Get Professional Help?

If you’re an American expat entrepreneur feeling overwhelmed by US tax compliance while growing your international business, Form 8993 might be your solution. This form calculates your Section 250 deduction for foreign-derived intangible income (FDII) and global intangible low-taxed income (GILTI), potentially eliminating substantial US tax liability when properly completed.

Form 8993 provides a 37.5% deduction for FDII and a 50% deduction for GILTI, which can translate to thousands in tax savings. We’ve helped thousands of expats with complex business forms like this, and many discover they owe far less than expected.

What Is Form 8993 and Who Must File It?

Form 8993 calculates your Section 250 deduction, which provides tax relief for US businesses earning income from foreign sources. The form determines two key deductions that can dramatically reduce your US tax bill:

- Foreign-Derived Intangible Income (FDII): Income from selling products or services to foreign customers

- Global Intangible Low-Taxed Income (GILTI): Income from foreign subsidiaries exceeding a 10% return on assets

You must file Form 8993 if you’re:

- A US corporation with foreign sales or foreign subsidiaries

- An American expat with a US corporation conducting international operations

- A business owner claiming Section 250 deductions for the 2025 tax year

This form applies to incorporated businesses, not sole proprietorships or partnerships. If you’re a freelancer or consultant abroad, you likely don’t need Form 8993 but may benefit from the Foreign Earned Income Exclusion instead.

How Can Form 8993 Reduce Your US Tax Bill?

The Section 250 deduction allows a 37.5% deduction for FDII and a 50% deduction for GILTI. Here’s how these savings work:

FDII Example:

- Your US corporation earns $100,000 from software sales to European customers

- After calculating your foreign-derived ratio, you have $80,000 in FDII

- Section 250 deduction: $80,000 × 37.5% = $30,000

- Tax savings: $30,000 × 21% corporate rate = $6,300

GILTI Example:

- Your foreign subsidiary generates $50,000 in excess returns

- Section 250 deduction: $50,000 × 50% = $25,000

- Tax savings: $25,000 × 21% corporate rate = $5,250

Many expat entrepreneurs miss these deductions because they don’t realize their international sales qualify for FDII treatment. That’s thousands of dollars in potential savings left unclaimed.

Get the Free Download That Makes Filing Taxes Simple

"*" indicates required fields

Do You Need to File Form 8993?

Form 8993 makes sense if you:

- Have significant foreign sales through a US corporation

- Own foreign subsidiaries generating substantial income

- Want to reduce US taxes on international business activities

- Can properly document your foreign-derived income

The form doesn’t apply if you:

- Operate as a sole proprietorship (use Form 2555 instead)

- Have minimal foreign-source income

- Lack proper documentation for foreign sales

What Are the Key Deadlines for Form 8993?

Form 8993 must be filed with your corporate tax return (Form 1120) by:

- March 17, 2026, for tax year 2025 returns

- September 15, 2026, with automatic extension

Unlike individual expat returns, corporations don’t receive the automatic June 15 extension. You must file Form 7004 to request additional time.

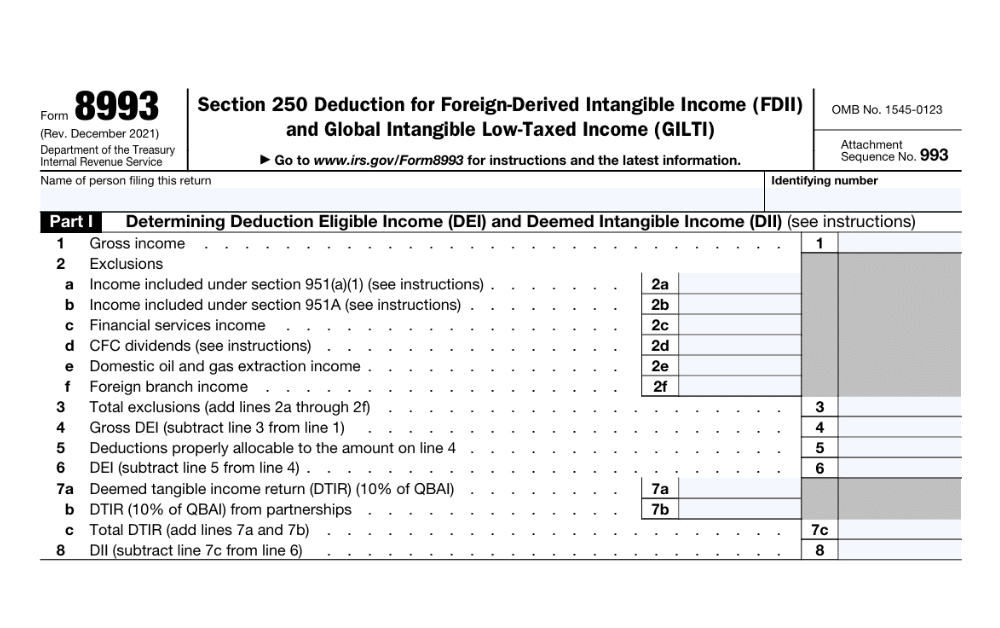

How Do You Calculate Your Section 250 Deduction?

Part I: Foreign-Derived Intangible Income (FDII)

- Step 1: Calculate your deduction eligible income (DEI) from Form 8992

- Step 2: Determine your deemed intangible income (DII)

- Step 3: Calculate your foreign-derived ratio based on foreign sales

- Step 4: Multiply DII by your foreign-derived ratio to get FDII

Part II: Global Intangible Low-Taxed Income (GILTI)

- Step 1: Enter the GILTI amount from Form 8992

- Step 2: Calculate your Section 250 deduction for GILTI

Part III: Section 250 Deduction

- Step 1: Apply the taxable income limitation

- Step 2: Calculate your final Section 250 deduction

The deduction cannot exceed 37.5% of your taxable income for FDII or 50% for GILTI, preventing the deduction from creating a loss.

What Are Common Expat Business Scenarios?

Software Developer in Germany

Sarah runs a US corporation in Berlin that sells software globally. Her $200,000 in foreign sales generates $75,000 in FDII deductions, saving her $15,750 in US taxes while qualifying for the Foreign Tax Credit on any remaining liability.

Manufacturing Business in Thailand

Mike’s US corporation manufactures products in Thailand for export. His foreign-derived income qualifies for FDII treatment, reducing his US tax bill by $12,000 annually.

Digital Marketing Agency in Portugal

Elena’s US corporation serves European clients exclusively. Her entire business income qualifies for FDII deductions, eliminating most of her US corporate tax liability.

What Are Common Form 8993 Mistakes to Avoid?

- Incorrect Foreign-Derived Ratio Calculation: Many expats miscalculate what constitutes “foreign use” of their products or services. The IRS provides specific guidance on determining where income is derived.

- Missing Documentation: Keep comprehensive records of foreign sales and customer locations. The IRS requires detailed documentation supporting your foreign-derived income claims.

- Overlooking the Taxable Income Limitation: The Section 250 deduction is limited to a percentage of your taxable income. Don’t assume you can deduct the full calculated amount.

- Forgetting About Foreign Tax Credits: Coordinate Form 8993 deductions with foreign tax credits to optimize your overall tax position.

What If You’re Behind on Filing?

If you’ve missed filing Form 8993 in previous years, you might be eligible for significant tax savings through amended returns. The IRS allows you to claim previously missed deductions within the statute of limitations.

No matter how late, messy, or complex your return may be, we can help. Our CPAs and Enrolled Agents have experience helping expat business owners claim Section 250 deductions they didn’t know existed.

How Does Form 8993 Coordinate with Other Expat Tax Benefits?

Form 8993 works at the corporate level, while individual expat benefits like the Foreign Earned Income Exclusion apply to personal income. You can often use both:

- Corporate level: Form 8993 reduces your corporation’s taxable income

- Individual level: FEIE excludes up to $130,000 of your personal foreign-earned income

- Credit coordination: The Foreign Tax Credit can offset remaining tax liability

This multi-layered approach often results in minimal US tax liability for expat entrepreneurs with proper planning.

Should You Get Professional Help?

Form 8993 involves complex calculations and detailed record-keeping requirements. Many expat entrepreneurs find the foreign-derived income calculations particularly challenging without professional guidance.

Our team has helped 23,000+ expats handle forms like Form 8993 while maintaining a 4.9-star average across 1,200+ TrustPilot reviews. We understand the unique challenges of running an international business while maintaining US tax compliance.

Form 8993 is part of our comprehensive business tax preparation services, which include GILTI calculations and controlled foreign corporation reporting.

What Are Your Next Steps?

- Review your business structure: Ensure you’re operating through a US corporation to claim Section 250 deductions

- Gather documentation: Collect records of foreign sales, customer locations, and subsidiary income

- Calculate potential savings: Estimate your FDII and GILTI deductions using the formulas above

- File Form 8993: Complete the form with your corporate tax return or amend previous returns

If you’re ready to optimize your expat business taxes and potentially save thousands through Section 250 deductions, you’ll have peace of mind knowing your taxes were done right.

Contact us, and one of our customer champions will gladly help. If you need specific advice on your tax situation, click below to get a consultation with one of our expat tax experts.

This article provides general information about Form 8993 and is general tax advice. Tax laws are complex and change frequently. Always consult with a qualified tax professional for advice specific to your situation.